mississippi auto sales tax calculator

Our free online Mississippi sales tax calculator calculates exact sales tax by state county city or ZIP code. 775 for vehicle over 50000.

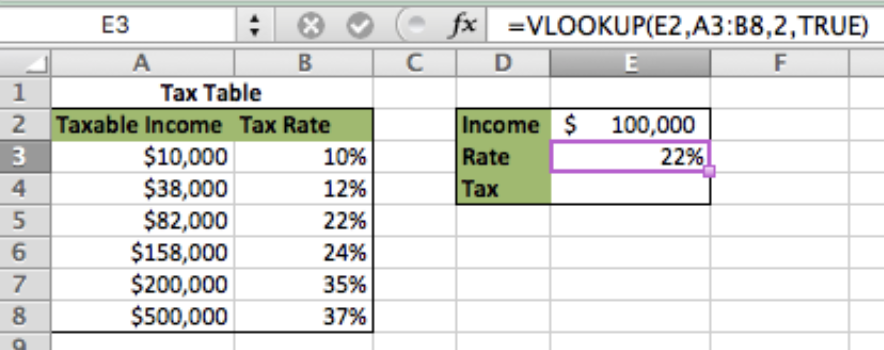

How To Calculate Income Tax In Excel

Motor vehicle titling and registration.

. The statewide sales tax in Mississippi is 5 on all new and used car purchases. 26 rows Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the time of registration.

The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. 635 for vehicle 50k or less. Essex Ct Pizza Restaurants.

Start filing your tax return now. 425 Motor Vehicle Document Fee. Opry Mills Breakfast Restaurants.

Sales Tax calculator Mississippi. For additional information click on the links below. Mississippi collects a 3 to 5 state sales tax.

Mississippi Back to School Sales Tax Holiday. Home Motor Vehicle Sales Tax Calculator. It is 6499 of the total taxes 81 billion raised in Mississippi.

Before-tax price sale tax rate and final or after-tax price. Mississippi Sales Tax Holidays. Your average tax rate is.

Registration fees are 1275 for renewals and 1400 for first time registrations. Depending on where you live you might have to pay an additional 1 county or local sales tax. In mississippi you pay privilege tax registration fees ad valorem taxes and possibly sales or use tax when you tag your vehicle.

The exact taxable value will vary for your vehicle based on the MSRP and the available state tax incentives. Mississippi Vehicle Tax Calculator. 635 for vehicle 50k or less.

Sales and Gross Receipts Taxes in Mississippi amounts to 53 billion. Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied. Mississippi salary tax calculator for the tax year 202122.

Find your state below to determine the total cost of your new car including the car tax. For vehicles that are being rented or leased see see taxation of leases and rentals. This means that you can get the lowest possible tax rate across most of the state.

In Mississippi you pay privilege tax registration fees ad valorem taxes and possibly sales or use tax when you tag your vehicle. Restaurants In Matthews Nc That Deliver. With local taxes the total sales tax rate is between 7000 and 8000.

TAX DAY NOW MAY 17th - There are -357 days left until taxes are due. Delivery Spanish Fork Restaurants. You can find these fees further down on the page.

Try our FREE income tax calculator. Mississippi collects a 3 to 5 state sales tax rate on the purchase of all vehicles. March 1 2022.

August 31-September 2 2018. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Auto sales tax and the cost of a new car tag are major factors in any tax title and license calculator.

In addition to taxes car purchases in Mississippi may be subject to other fees like registration title and plate fees. Soldier For Life Fort Campbell. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

Registration fees are 1275 for renewals and 1400 for first time registrations. All the other taxes are based on the type of vehicle the value of that vehicle and where you live city county. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

Motor Vehicle Ad Valorem Taxes. Motor vehicle ad valorem tax is based on the assessed value of the vehicle multiplied by the millage rate set by the local county government. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

During the year to deduct sales tax instead of income tax if. Mississippi Firearms and Ammunition Sales Tax Holiday. Mississippi Vehicle Sales Tax Calculator.

Keep in mind that the original price. Mississippi Income Tax Calculator 2021. Car tax as listed.

Some states provide official vehicle registration fee calculators while others provide lists of their tax tag and title fees. Tax Mississippi car tax is 189125 at 500 based on an amount of 37825 combined from the price of 39750 plus the doc fee of 275 minus the trade-in value of 2200. Income Tax Rate Indonesia.

Fortunately a large number of counties in Mississippi forgo the additional 1 tax.

Excel Formula Income Tax Bracket Calculation Exceljet

What S The Car Sales Tax In Each State Find The Best Car Price

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel Tutorial Youtube

Casio Ms 10vc Be 10 Digit Calculator Blue Desktop Extra Large Display Solar Plus Calculator 2 Way Powe Calculator Desktop Calculator Basic Calculator

How To Calculate Sales Tax In Excel

Excel Formula Basic Tax Rate Calculation With Vlookup Excelchat

11 Invoice Templates For All Businesses Invoice Template Invoice Template Word Excel Templates

7 Mileage Log Templates Free Pdf Doc Mileage Log Printable Mileage Mileage Tracker

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

How To Calculate Income Tax In Excel

How To Calculate Sales Tax In Excel

Car Sales Tax In Mississippi Getjerry Com

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

How To Calculate Income Tax In Excel

Free Vehicle Maintenance Log Template For Excel Fleet Maintenance Tracking Montana Finance Vehicle Maintenance Log Maintenance Checklist Car Maintenance